SingaporeMotherhood | Parenting

August 2023

“I’m a Young Mum, Smart and Savvy, but I Fell for a Scam!”

This can’t be happening! I stared in disbelief for a second. Then panicking, I frantically tapped on my phone to try to uninstall the new app, but to no avail. In a state of shock, I watched my DBS and UOB banking apps automatically open and issue OTP requests. It was clear the scammer was remotely controlling my mobile phone right before my eyes! My hands frozen, my mind in shock and denial that I had fallen for a scam, but I knew I had to act quickly.

First Things First: Lockdown!

Immediately, I swiped up both bank apps to close them, ended the WhatsApp call with the scammer, and googled for the DBS hotline number to block all outgoing transfers. I selected #7 for scams and in a minute the staff confirmed all transactions were halted.

“Please call me back in an hour to update me if any money has been transferred out. I need to quickly call three other banks now,” I said hurriedly.

I wasn’t sure which bank they had targeted but I knew time was critical. Every second could mean another account emptied. My phone screen was now flickering, which made it hard to see what was happening.

(See also: GUIDE TO INVESTMENT FOR STAY-AT-HOME MUMS (+ A REAL-LIFE SAHM SHARES))

My second call was to my trading platform because I had a significant amount in that account. The lady wasn’t sure if she could block any outgoing transfers. Again, I chose not to politely wait as she checked, hastily explaining that I had other calls to make. She understood the urgency and we quickly hung up.

At that point, I decided to shut down my phone completely and head to the nearby mall to check with the banks there in person. Fear raced through my mind as I ran all the way, wondering how I could have been so naive.

Next Step: Report!

Handing my IC to the OCBC staff at the entrance, I said I was a victim of a scam and to stop any transactions immediately. As I communicated that I had two other banks to settle, he nodded. I sprang down the escalator to the next bank, headed straight to the front of the queue, and blurted out, “I’ve been scammed!”

The counter staff at DBS ushered me to a colleague, who would attend to me as soon as she finished with the current customer. Meanwhile, not wanting to risk switching on my phone, I borrowed theirs to call the fourth bank. I reasoned that the scammers would not be able to remotely control a device that was switched off.

In less than 30 minutes, I had blocked all four bank accounts and associated credit cards. I returned to OCBC to check if I had lost any money. They assured me that the bank had recently installed additional protection so third-party apps couldn’t make unauthorised transfers.

(See also: 10 CRUCIAL ONLINE SAFETY TIPS FOR KIDS AND PARENTS)

Next, I rushed to a nearby handphone shop and requested for a hard reset because I wanted the malware out of my device. Even the staff had difficulty performing a factory reset because my screen kept flickering on and off. I figured the loss of photos and the inconvenience of reinstalling apps was a small price to pay compared to my life’s savings!

Finally, I headed to the police station because I was now determined to help the authorities catch this scam syndicate. I shared the scammer’s WhatsApp number, our message history, and their website. I even offered to bait the scammers but the police told me to cease all communication with them.

Back home, I processed the entire event from start to finish, and distilled three key lessons:

#1. Be Humble and Exercise Caution

We are a nation of trusting people who leave our belongings on a table at Starbucks when taking a toilet break, expecting to find our laptop untouched when we return. But while local crime rates may be low, it does not buffer us from digital crimes and exorbitant financial losses. It’s little wonder that scam syndicates target us.

Like many others in my demographic, I mistakenly believed scammers only target older folks or the less ‘educated’. Yet, I am humbled by what I fell for.

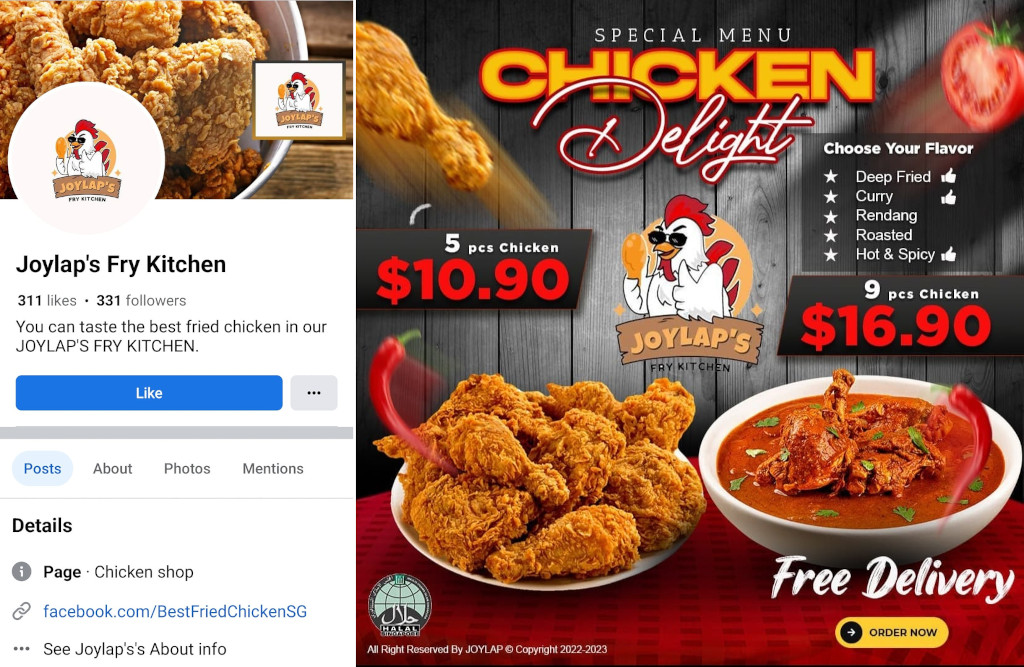

It was just another FaceBook ad — this one for fried chicken delivery. The price was similar to Popeyes’ anniversary deal so I thought it would be a good dinner treat. The lure of a hassle-free meal for my family was all it took. That’s how innocent they appear, but an order of fried chicken could have emptied my bank accounts!

It could be a healthy tingkat (tiffin carrier) subscription, affordable cleaning service, believable additional income, attractive pet grooming, simple companionship, guaranteed tuition results…. The advertisements vary. But one thing they all have in common? These baits appeal to our needs.

(See also: 14 TINGKAT FOOD DELIVERY SERVICES IN SINGAPORE TO SATISFY EVERY FOODIE)

A daughter looking out for her parents, a tired mum who has no time, gig workers looking for extra sources of income, indulgent pet owners, a neglected and lonely spouse, a student who wants to make her parents proud.

Today’s digital scams have evolved, their baits more sophisticated than the infamous get-rich-quick scheme. They prey on the unsuspecting natures of savvy, confident folk.

It’s not about our intellect, I told my kids over dinner. When someone has bad intentions, they’ve premeditated the entire set-up. Educating ourselves on different schemes puts us in a better position to recognise and outwit them if we are ever caught in one.

#2. Beware Different Scam Set-ups

In my case, the scammer followed up for an entire week after I first indicated interest. Via WhatsApp, he reminded me the promotion was ending soon. In hindsight, that was the first tiny red flag. I thought it interesting that they would provide such personalised service for something so affordable.

But he patiently answered my questions, and also accommodated three changes to my order. He even threw in five servings of mashed potato and two small boxes of chicken nuggets. What was a nice-to-have turned into a super attractive deal!

He then sent me a link and asked for partial payment up front, which I thought was fair. When payment didn’t go through, I wondered, but he had a plausible explanation — their website was temporarily down. I needed to download an app to place the order.

I wasn’t keen because of my phone’s limited storage space and I asked if I could PayNow him directly. He explained that the company needed the official order number, and also pointed out that I could delete the app after ordering. Again, it made sense.

(See also: HBL TIPS AND TOOLS – SAFEGUARD YOUR KIDS ONLINE AND ENHANCE THEIR HOME-BASED LEARNING)

He offered to guide me over a short call. In three quick swipes, I allowed access from my phone security settings. It happened so fast that I didn’t foresee the repercussions. The app installed, but growing increasingly uneasy, I heeded my intuition to test an existing app. It flickered. Definitely not normal.

I told him something seemed wrong and he brushed aside my concern while continuing to describe my order. That set off the final alarm bells. It was a stall tactic to distract me while his accomplices were freely going through my phone!

My Scam Research Findings

Now I know that I had unwittingly given them access to everything on my mobile phone, including my contacts, trading, banking and Singpass apps! Of course, what they were after was money in the banks. They could raise payment limits, transfer money out, and erase their tracks by deleting bank notifications within an hour.

My friend lost $75,000 through an online trading platform that resembled a major banking website. All it took was three days for identity theft and a depleted bank account. The entire set-up appeared so ‘legit’, she didn’t even suspect fraud until she saw other victims in the queue ahead of her at the police station reporting similar stories.

I read about how another lady had her credit card limit raised, the cash value transferred into her savings account, and then her entire savings account depleted. The scammers took more than just her savings; she was liable for the credit card debt!

Other common set-ups:

• Job offers with lucrative commissions to work from home – never download unfamiliar apps

• Messages or calls from banks or government agencies requiring immediate attention – beware of counterfeit links

• E-commerce purchases requiring external transactions – dodge APK (Android Package Kit) files from third party apps

Even at the point of writing this, I know that new ploys will continue to pop up. This is why as members of society, we need to level up our awareness, and speak out against scam syndicates.

#3. Educate the Vulnerable: Children & Elderly

Impersonators target our law-abiding older generation, who easily panic when they receive warnings from government organisations or major corporations. Scammers might masquerade as HDB officers, MOH personnel, traffic police, SingPost, or banks.

Let’s make it a point to inform them of such scam tactics so they are not caught off-guard. Share with your neighbours or classmate’s parents too. They may not have someone to share with them.

We need to brief our children on scams too. My 11-year-old daughter was scammed of her Roblox collectibles by another player who convinced her to perform a ‘trust trade’.

This player was in for the longer and bigger game than what they were playing — Murder Mystery 2. She unhurriedly took months to build trust, becoming my daughter’s ‘best’ online friend. One day, she asked to meet in my daughter’s private server (digital room) to discuss a trade of their Godlies (digital collectibles).

(See also: CYBERBULLYING IN SINGAPORE: IS MY CHILD A VICTIM?)

What seemed like a good deal reduced my daughter to tears the moment she realised she was the victim of a scam. Upon receiving my daughter’s Godlies, her ‘best friend’ left the room and blocked her. “I skipped recess on some days and saved months of pocket money to buy those valuable Godlies. And now, everything is gone!” I held her as she sobbed.

Of my five kids, she is generally the most astute. The one who would bargain for a better deal for her elder sister, boldly tell a stranger to back off when he approached her younger sister, and correctly guess the identity of the culprit in any thriller. She’s a smart cookie! And yet, all her intelligence did not protect her from the premeditated betrayal of a ‘friend’.

Surviving Scam City

The landscape we live in has changed. Devices we own are potential doorways for digital crimes to walk right into our homes, and even our hearts!

We need to level up to stay relevant and protect our families, communities, and the society we live in. I found out that my chicken ad has gone regional — it’s now targeting Indonesia, Malaysia, and the Philippines!

Share this article with all your friends, have dinnertime conversations with your children this week, reach out to that quiet neighbour, inform your domestic helper, and call your elderly parents.

Scammers may be becoming more and more prolific, but it’s not a time to shrink back and hide. Instead, let’s band together and take a united stand to push back against digital threats.

| Author of “The Naked Parent”, founder of Mum Space, and mother to five amazing children, Junia is a respected thought-leader in the parenting space. Recognised for empowering parents and kids with her 21st-century parenting model for over a decade, she now brings her ‘Modern Asian Mother’ expertise and experience to this exclusive SingaporeMotherhood column. |

Featured image: Freepik

All content from this article, including images, cannot be reproduced without credits or written permission from SingaporeMotherhood.

Follow us on Facebook, Instagram, and Telegram for the latest article and promotion updates.