SingaporeMotherhood | Parenting

February 2023

10 Ways to Use Your CPF & MediSave for Your Family’s Healthcare Needs

Are you part of the ‘sandwich’ generation? This refers to working adults who support their ageing parents while raising a family. The burden can be quite heavy, especially when it comes to healthcare costs. Besides using MediSave for your own needs, did you know that you can also fund your loved ones’ medical expenses? These range from making CPF top-ups for your parents to paying for your child’s asthma treatments. Let’s find out more.

(See also: Budget 2023: Bigger Baby Bonus + More Benefits and Subsidies for Parents)

What is CPF?

The Central Provident Fund (CPF) is a compulsory savings and pension plan for working Singaporeans and permanent residents (PRs). It is primarily used to fund an individual’s retirement, healthcare, and housing needs in Singapore.

Both employees and employers contribute to an individual’s CPF. Funds are then allocated into different accounts: Ordinary Account (OA), Special Account (SA), Retirement Account (RA), and MediSave. You will be able to use the funds in each account for different purposes.

(See also: Retirement 101 for Parents in Singapore)

What is MediSave?

MediSave is a savings scheme that helps Singapore Citizens (SCs) and PRs set aside part of their monthly income to fund healthcare needs. Since MediSave is one of the accounts under CPF, all CPF members automatically contribute a part of their salary to their MediSave account.

MediSave can be used for approved medical expenses, including hospitalisation, day surgery, selected outpatient services, and healthcare needs for seniors.

To ensure that Singaporeans have enough savings for basic healthcare needs in old age, there are withdrawal limits set for MediSave. However, fret not, as these withdrawal limits are usually sufficient to cover most subsidised medical charges.

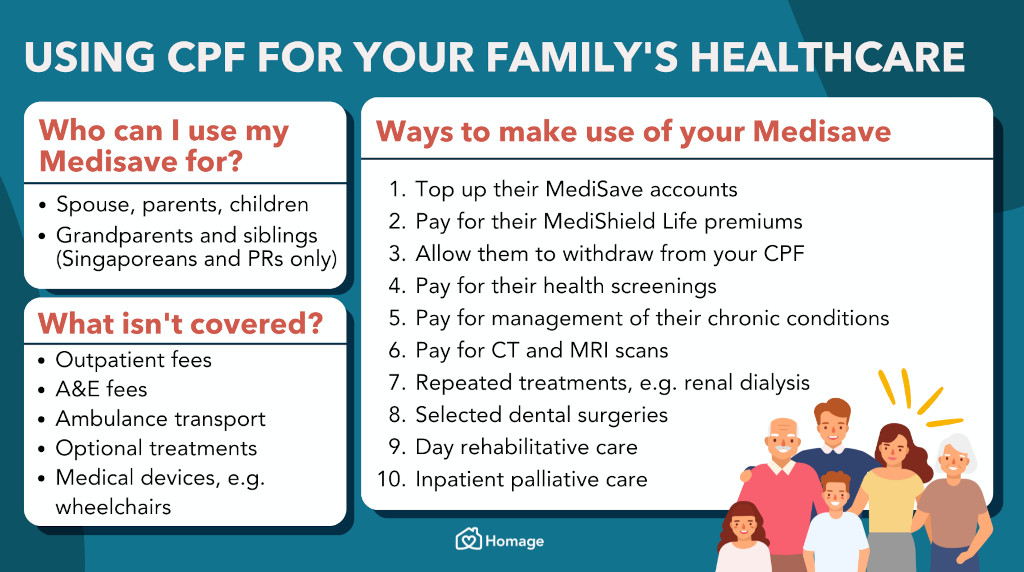

Who can I use my MediSave for?

Aside from using MediSave to fund your own healthcare, you can also use it to help defray some of your family members’ medical expenses. These include your:

- Spouse, parents, and children (regardless of nationality)

- Grandparents and siblings (must be SCs or PRs)

What services can I use my MediSave for?

MediSave can cover a variety of healthcare expenses, including:

- Outpatient care

- Chronic disease management

- Vaccinations

- Health screenings

- CT/MRI scans

- Assisted conception

- Hospitalisation

- Day surgery

- Maternity packages

- Rehabilitation therapy

- Palliative care

- Disability care

In addition, it can be used to pay your insurance premiums for MediShield Life, Integrated Shield Plans, ElderShield, and CareShield Life.

(See also: MediSave for Pregnancy and TTC – Financial Aid for Making Babies)

What cannot be paid with my MediSave?

Services that cannot be paid with MediSave include:

- Outpatient consultation fees, tests, and investigations (except for treatments approved under the Chronic Disease Management Programme)

- Accident and emergency (A&E) fees

- Non-medical treatments (e.g. ambulance transport)

- Optional and cosmetic treatments

- Medical equipment, devices, and appliances (e.g. wheelchairs)

If you need financial support for these services, other various healthcare subsidies are available.

10 Ways to Use CPF and MediSave for My Family Members

Here are some ways you can use the funds in your CPF and MediSave for your loved ones’ care needs:

1. Top up their MediSave accounts

Firstly, you can support your loved one by transferring funds from your CPF SA and/or OA to their MediSave. The amount you can transfer to their MediSave account depends on the:

- Available balance in your SA and OA

- Amount that you wish to contribute

- Shortfall of your recipient’s Basic Healthcare Sum (BHS). From January 2023, the BHS is $68,500 for those turning 65 years old.

- Do note that funds will be transferred from your SA first, followed by your OA. The interest balance in your SA and OA is not transferable.

Fill up this form to apply for the CPF transfer.

2. Pay for their MediShield Life insurance premiums

Did you know that you can use MediSave to pay your MediShield Life insurance premiums in full?

MediShield Life is a basic healthcare insurance plan for all Singaporeans. It provides lifelong coverage for hospital bills and selected outpatient treatments, such as dialysis and chemotherapy. This reduces the amount that individuals will have to fork out from their MediSave and in cash.

Using MediSave to pay for insurance premiums takes a load off those who are tight on cash or prefer to use their money for other purposes. If your loved one is unable to afford the MediShield Life premiums, you can offer to use your MediSave to pay for their premiums.

To help fund your loved one’s MediShield Life insurance premiums using your MediSave, apply here. You will receive notice before any deductions, and can review the arrangement at any time.

(See also: She Suffered a Stroke while Pregnant at Seven Months)

3. Letting them tap into your CPF for MediSave Care

MediSave Care is a long-term healthcare scheme that allows SCs and PRs aged 30 and above with severe disability to withdraw up to $200 per month from their and/or their spouse’s MediSave.

However, to ensure sufficient funds for other medical needs, you must maintain a minimum balance of $5,000 in your MediSave account. Those with less than $20,000 remaining in their MediSave account will also be subjected to a lower monthly withdrawal limit for MediSave Care.

For example, if Mdm Foong, an individual with severe disability, has $13,000 in her MediSave account, she will only be able to withdraw $100 from her account. However, she can tap on her spouse’s MediSave to withdraw the remaining $100 to hit the maximum withdrawal limit of $200 (provided her spouse has at least $10,000 in his MediSave).

Do note that this arrangement of tapping into your loved one’s CPF for MediSave Care is currently only available for spouses. Find out more here.

4. Pay for their yearly health screenings

As the saying goes, prevention is better than cure. Going for screenings regularly is important to spot the early warning signs of health conditions, so you can seek treatment before complications develop.

The government subsidises screening tests and health check-ups to make them more affordable. With the Screen for Life (SFL) programme, Singaporeans can go for recommended screening tests starting from just $2. However, more comprehensive health screening packages beyond the basic tests included in SFL will cost more.

Thankfully, you can use MediSave to pay for your or your loved ones’ screening tests at participating medical institutions. Here are the eligible screenings and the respective MediSave withdrawal limits:

| Health Screening | Conditions | MediSave Withdrawal Limit |

|---|---|---|

| Mammogram | Aged 50 years and above | $700 for individuals with complex chronic conditions $500 for individuals without complex chronic conditions |

| Colonoscopy | Aged 50 years and above | $950 for procedure-related cost and $300 for related hospital charges |

| Colonoscopy with removal of polyps | Day surgery procedures only | $1,250 for colonoscopy with the removal of a single polyp or multiple polyps less than 1 cm, and $300 for related hospital charges $1,550 for colonoscopy with the removal of multiple polyps more than 1 cm, and $300 for related hospital charges |

(See also: Mammograms in Singapore – Subsidised Breast Cancer Screening Programmes & Costs)

5. Pay for treatment of their chronic diseases

If your loved one is under the Chronic Disease Management Programme (CDMP), they can use their or their loved one’s MediSave for outpatient treatments. You can access this programme at public hospital Specialist Outpatient Clinics, polyclinics, and more than 1,250 GP clinics and private specialist clinics around Singapore.

The 23 conditions under CDMP are:

- Allergic rhinitis

- Anxiety

- Asthma

- Benign prostatic hyperplasia

- Bipolar disorder

- Chronic hepatitis B

- Chronic obstructive pulmonary disease (COPD)

- Dementia

- Diabetes mellitus

- Epilepsy

- Gout

- Hyperlipidemia (lipid disorders)

- Hypertension (high blood pressure)

- Ischaemic heart disease

- Major depression

- Nephrosis/nephritis

- Osteoarthritis

- Osteoporosis

- Parkinson’s disease

- Psoriasis

- Rheumatoid arthritis

- Schizophrenia

- Stroke

You are considered to have complex chronic conditions if you see the doctor for two or more CDMP conditions, or one CDMP condition with complications, within a year.

Individuals with complex chronic conditions can withdraw up to $700 per year per individual from MediSave for outpatient chronic condition treatments, while others under CDMP can use up to $500. Each claim is subjected to a 15% co-payment in cash.

If you are using your MediSave to support multiple family members with chronic conditions, you will be able to withdraw up to $500 or $700 per recipient respectively.

For example, David is supporting his father who has diabetes and arthritis, as well as his daughter who has asthma with no major complications. This means he can withdraw up to a total of $1,200 per year from his MediSave for chronic condition management — up to $700 per year for his father and up to $500 per year for his daughter.

(See also: Your Child has Asthma? Here are 8 Ways to Help)

6. Pay for their CT and MRI scans

CT and MRI scans can be costly. So you will be glad to know that you can use your MediSave to support your loved one’s outpatient scans. You can withdraw up to $300 per year per individual.

Those with cancer can claim up to $600 per year for outpatient MRI scans, CT scans, and other diagnostics related to the treatment. Do note that X-rays are not covered under this use case.

7. Pay for repeated treatments

If your loved one needs to go for repeated treatments due to conditions like cancer, kidney failure, or end-stage renal disease, medical expenses can add up over time. You can support them by using your MediSave to ease the burden of their medical expenses.

For renal dialysis, you can withdraw up to $450 per month. Those with cancer can claim up to $600 or $1,200 per month for cancer drug treatments, and from $80 to $2,800 for radiotherapy, depending on the type of treatment.

8. Pay for their dental surgical procedures

Selected dental surgical procedures are also MediSave-claimable. Examples include wisdom tooth surgery, dental implant, bone grafting, gum grafting or surgery, sinus lift, and crown lengthening. Depending on the complexity of the procedure, you can withdraw between $250 and $2,850 from MediSave.

If your loved one’s MediSave account has insufficient balance, you can use your MediSave to cover the cost of their dental procedure.

(See also: Best Kids Dentists & Family-friendly Dental Clinics in Singapore + Costs)

9. Pay for rehabilitative care

If your loved one is recovering from an accident or illness and requires rehabilitation, you can use your MediSave to offset some of the costs.

If they require inpatient rehabilitation treatment at a community hospital, you can withdraw up to $250 per day and up to $5,000 per year from MediSave. For outpatient treatment at a day rehabilitation centre, you can withdraw up to $25 per day and up to $1,500 per year.

Community hospitals are public health institutions that provide short-term medical care to those who have just been discharged. They complement acute care general hospitals to ensure care continuity and a smooth transition home.

Day rehabilitation centres are healthcare facilities with equipment, resources, and trained staff that can support your recovery with outpatient physical therapy.

If you are using your MediSave to pay for your loved one’s rehabilitation care at either of these facilities, do let the staff know in advance so they can guide you through the necessary procedures.

10. Pay for palliative care

Palliative care aims to improve the quality of life of individuals with life-limiting conditions and support their family in various aspects of their lives.

Whether your loved one requires inpatient palliative care at a community hospital or hospice, you can withdraw up to $250 (for general care) or $350 (for specialised care) per day from your MediSave to pay for approved inpatient hospice palliative care services (IHPCS).

For home palliative care, there is a lifetime limit of $2,500 per individual for MediSave withdrawal. This lifetime limit is shared with Day Hospice Care. However, if the patient is diagnosed with terminal cancer or end-stage organ failure and is using their own MediSave, the lifetime limit will not apply.

This article first appeared on Homage, an award-winning personal care solution that provides on-demand holistic home and community-based caregiving and medical services to seniors and adults, allowing them to age and recover with grace, control, and dignity.

All content from this article, including images, cannot be reproduced without credits or written permission from SingaporeMotherhood.

Follow us on Facebook, Instagram, and Telegram for the latest article and promotion updates.