SingaporeMotherhood | Parenting

April 2020

Income Tax Reliefs for Parents – Are You Maximising Your Tax Savings?

Did you know that you can save on paying income tax by taking advantage of various reliefs and rebates? Many parents, especially new ones, are confused by all the different income tax reliefs and rebates available. With income tax season upon us again, we thought it would be a good idea to offer a quick guide to income tax reliefs and rebates targeted specifically at parents.

But first, a quick reminder of the due dates for all you busy mums and dads. Submit your hardcopy tax return by 15 April if you’re old-school. For everyone else, you have until 18 April to complete e-filing online. **IN LIGHT OF COVID-19, THIS YEAR’S FILING DEADLINE HAS BEEN EXTENDED TO 31 MAY 2020**

Income Tax Reliefs for Both Parents

Parenthood Tax Rebate (PTR)

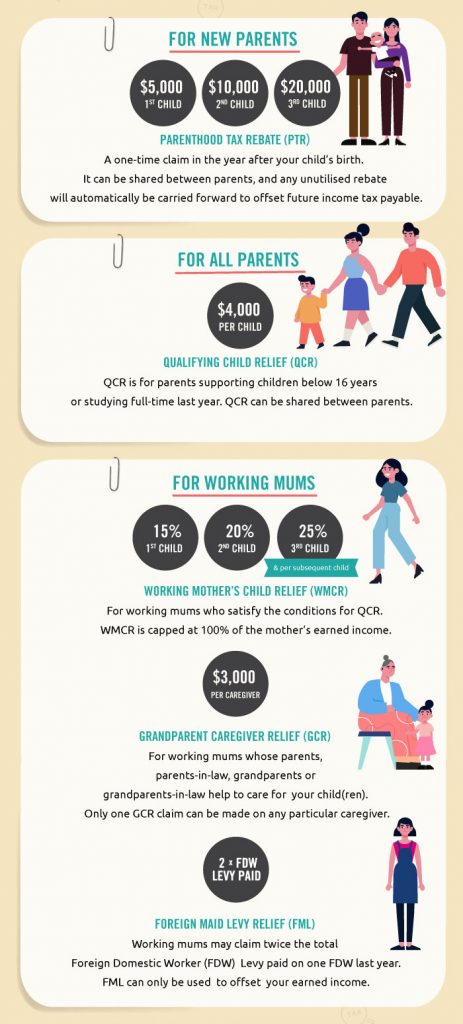

1st child: $5,000 | 2nd child: $10,000 | 3rd child & beyond: $20,000

To encourage couples to have kids, parents receive a one-time PTR for each child in the year following their birth. You get $5,000 for your first child, $10,000 for your second child, and $20,000 for your third and subsequent child. Parents can share the PTR, and any unutilised balance will be automatically carried forward to offset future your income tax.

(See also: 10 Things To Do after your Baby is Born)

Qualifying Child Relief (QCR)

$4,000 per child

To help you on your parenting journey, you can claim $4,000 in QCR per child each year. To qualify for QCR, your child must be below 16 years old. If they are above 16, they must be studying full-time and/or not have an annual income above $4,000 last year. Parents can share the QCR.

Handicapped Child Relief (HCR)

$7,500 per child

If you have a disabled child, you can claim $7,500 in HCR (instead of QCR) per child each year. HCR is applicable in cases of physical and mental disabilities, and if your child is attending a Special Education (SPED) school, or has significant special needs. Parents can share the HCR.

(See also: SNTC offers Peace of Mind for Parents of a Special-needs Child)

Income Tax Reliefs for Working Mums

Working Mother’s Child Relief (WMCR)

1st child: 15% | 2nd child: 20% | 3rd child & beyond: 25% (of your earned income)

To encourage more women to stay in the workforce after having kids, working mums can claim WMCR. You get 15 per cent of your annual income for your first child, 20 per cent on your second child, and 25 per cent on your third and subsequent child. The total WMCR you can claim is capped at 100 per cent of the income you earned last year. Also, the total cap for QCR/HCR plus WMCR is $50,000 per child.

(See also: 12 Tips to Help Stay-at-home Mums Prepare to go back to Work)

Grandparent Caregiver Relief (GCR)

$3,000 for 1 caregiver

Working mums who tap on their parents or grandparents to help look after their children can claim $3,000 in GCR. To qualify, your kids have to be 12 years and under last year, or is disabled. It also applies if it’s your husband’s parents or grandparents, but you can only claim on one caregiver. Other conditions include the caregiver not working last year, and no one else claiming GCR on the same caregiver.

Foreign Maid Levy (FML) Relief

2 x FML paid on 1 helper

FML Relief is given to encourage married women to keep working. If you or your husband employed a foreign domestic worker last year, you can claim twice the amount of FML paid but only on one helper. You can claim GCR and FML Relief concurrently if you meet qualifying conditions for both.

(See also: There’s No Escaping Mummy Guilt No Matter What Type of Mum You Are!)

Useful Links

Parents, do make sure you claim any and all income tax reliefs you are eligible for to maximise your savings. Of course, you have to meet the qualifying conditions in the Year of Assessment. In other words, you can only claim child-related income tax reliefs in 2020 for children born in 2019 or earlier. Also, there is a maximum cap of $80,000 in personal income tax reliefs each year.

There are a few additional reliefs that aren’t child-related, but may still be relevant to you and your family. These include:

- NSman Self Relief / NSman Wife Relief – learn more

- Spouse Relief / Handicapped Spouse Relief – learn more

- Parent Relief / Handicapped Parent Relief – learn more

We hope this guide to income tax reliefs for parents has been helpful. For further details, visit the IRAS website. You can also download the Personal Reliefs Eligibility Tool to calculate how much you can claim. If you have more questions, here’s the complete guide to Tax Season 2020. When you’re ready, head over to the myTax Portal to e-file your income tax!

(See also: MediSave for Pregnancy – Maximise Your Claims and Minimise Your Costs)

All content from this article, including images, cannot be reproduced without credits or written permission from SingaporeMotherhood.

Follow us on Facebook, Instagram, and Telegram for the latest article and promotion updates.